Rivian (RIVN) will report its third-quarter earnings on Thursday after market shut. After a provide scarcity hampered manufacturing, buyers are questioning if the EV maker will see its first income drop since turning into a public firm. Right here’s what to observe for in Rivian’s Q3 2024 earnings report.

What to anticipate from Rivian’s Q3 2024 earnings

Rivian delivered 10,018 autos within the third quarter, 27% fewer than the 13,790 handed over in Q2 2024.

After a provide scarcity started in Q3, impacting the R1T, R1S, and electrical supply vans (EDVs), Rivian lower its manufacturing goal for the yr. As an alternative of the earlier 57,000, Rivian now expects to construct between 47,000 and 49,000 autos in 2024.

With one other 13,157 constructed final quarter, Rivian’s manufacturing complete reached 36,749 by way of the primary 9 months of 2024. This implies one other 12,251 to 10,251 EVs will have to be made at its Regular, IL plant within the remaining three months of the yr.

Regardless of the decrease manufacturing outlook, Rivian expects barely extra deliveries than final yr. Rivian plans to ship between 50,500 and 52,000 EVs in 2024, up from 50,122 in 2023.

| Q1 2024 | Q2 2024 | Q3 2024 | 2024 YTD | 2024 steerage | |

| Deliveries | 13,588 | 13,790 | 10,018 | 37,396 | 50,500 – 52,000 |

| Manufacturing | 13,980 | 9,612 | 13,157 | 36,749 | 47,000 – 49,000 |

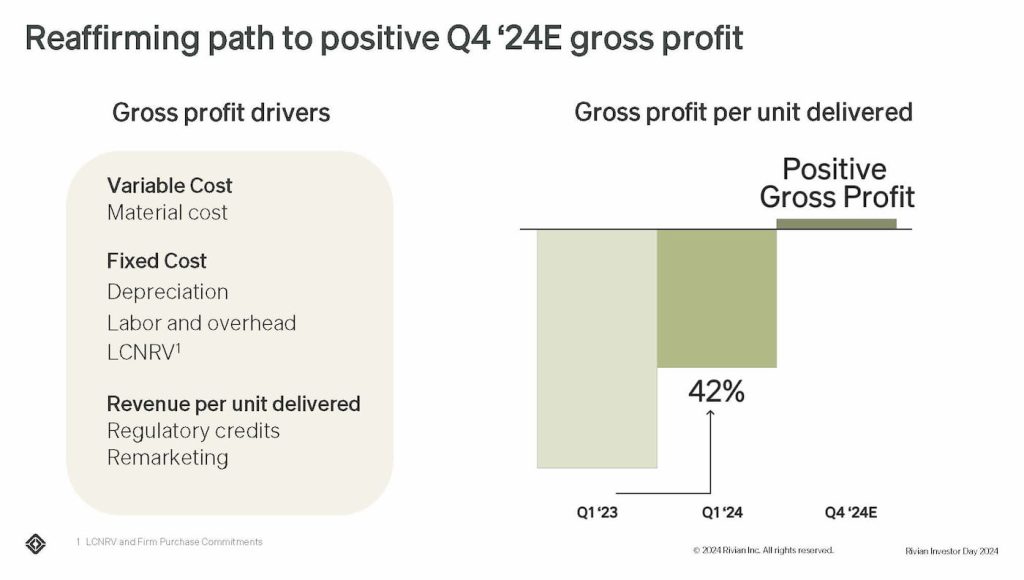

Though throughout its first Investor Day in July, Rivian stated it nonetheless expects to realize its first revenue in This fall 2024, the provision scarcity could have thrown plans off.

In response to a current Bloomberg report, the scarcity was brought on by a miscommunication with its provider, Essex Furukawa, earlier this yr. The mishap has left Rivian with out sufficient copper windings to hit its preliminary manufacturing goal.

| Q3 ’22 | This fall ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | This fall ’23 | Q1 ’24 | Q2 ’24 | |

| Rivian loss per car | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 |

Rivian’s losses reached $1.46 billion within the second quarter, up from $1.2 billion in Q2 2023. The corporate misplaced $32,705 on each EV constructed final quarter. Will the losses enhance regardless of decrease output?

In preparation for its smaller, extra reasonably priced R2, Rivian has been aggressively chopping prices and introducing new tech, which is enabling a lot decrease manufacturing prices.

Rivian’s CEO RJ Scaringe stated upgrades at its Regular, IL plant earlier this yr have been a “pivotal” second. Along with its superior new tech and improved provider relations, the change will allow “important price reductions,” in accordance with Scaringe.

Wanting forward

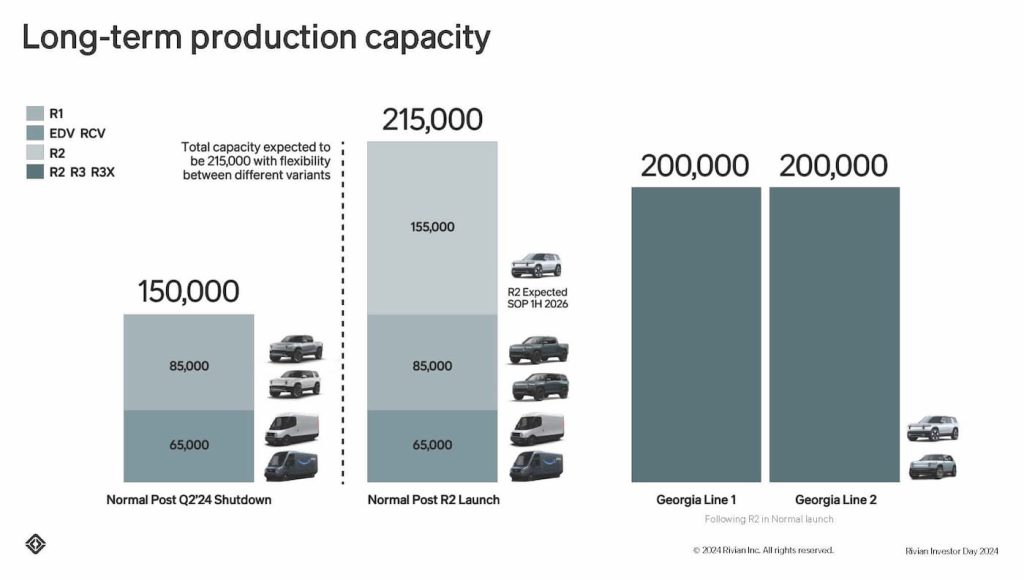

The brand new tech will function the muse for Rivian’s next-gen R2. Rivian is predicted to start R2 manufacturing at its Regular facility in early 2026.

Beginning at $45,00, the R2 is almost half the price of Rivian’s present R1S and R1T, which is predicted to assist drastically broaden its market.

As soon as R2 manufacturing begins, Rivian expects the brand new EV will account for many of its output. The corporate plans to construct 155,000 R2 fashions yearly and about 85,000 R1S and R1Ts in Regular.

Rivian additionally acquired backing from Volkswagen by way of a brand new software program alliance for next-gen EVs. Volkswagen will make investments as much as $5 billion, $3 billion of which can go to Rivian and $2 billion for the three way partnership. Nevertheless, these are based mostly on efficiency targets.

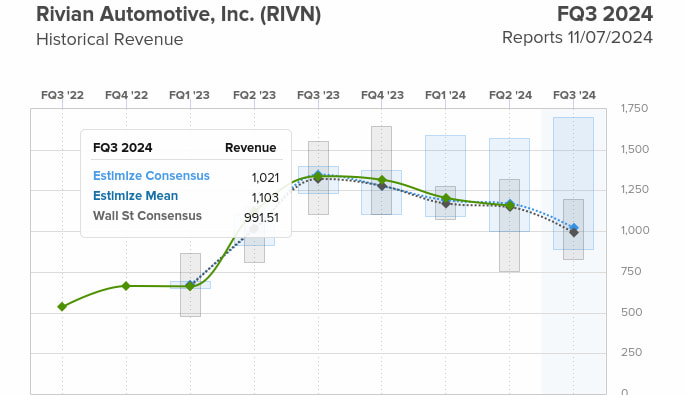

In response to Estimize, Rivian is predicted to report a lack of $0.96 per share in Q3 2024, an enchancment from the 1.19 loss per share final yr. Rivian is predicted to report round $1 billion in income, which might be a 26% drop from the $1.34 billion in Q3 2023.

Rivian’s inventory is down over 53% in 2024 and over 90% from its all-time excessive set shortly after going public in November 2021.

Examine again tomorrow after the market closes for a breakdown of Rivian’s third-quarter earnings.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.